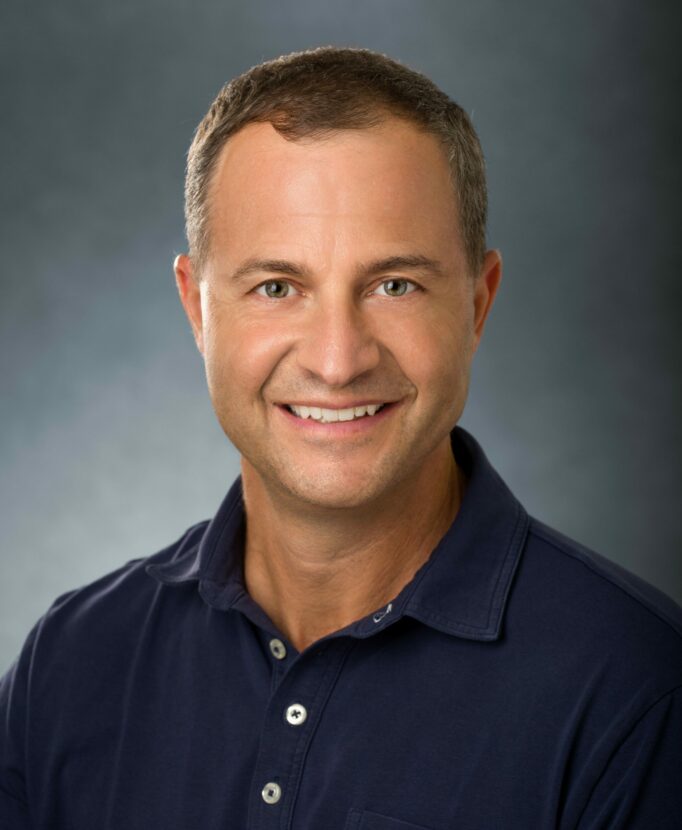

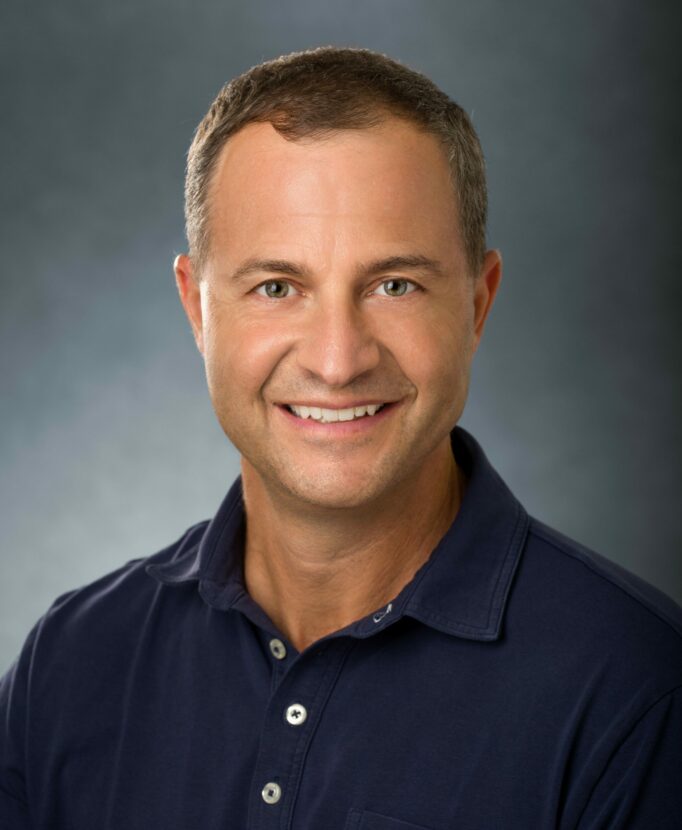

Ted Seides

Ted Seides on Index Funds

Ted Seides on Index Funds

Keynote Speaker

Ted Seides, CFA is the Founder of Capital Allocators LLC, which he created in 2016 to explore best practices in the asset management industry from the perspective of asset owners, asset managers, and interdisciplinary thought leaders.

CONTACT WSB FOR Ted Seides'S SPEAKING FEES

Ted Seides hosts the Capital Allocators podcast, co-hosts Capital Allocators Summits, advises asset managers and allocators across audio content, investing, and business strategy, and is a columnist for Institutional Investor.

The Capital Allocators podcast has been downloaded 5 million times as of January 2021 and reaches a weekly audience of more than 50,000, including many of the world’s leading institutional investors and asset managers.

In March 2021, Ted published his second book, Capital Allocators: How the world’s elite money managers lead and invest to distill the lessons from the first 150 episodes of the podcast.

Previously, Ted was a founder and served as President and Co-Chief Investment Officer of Protégé Partners, LLC, where he spent 14 years leading the multi-billion-dollar alternative investment firm that invested in and seeded hedge funds.

Ted began his career in 1992 under the tutelage of David Swensen at the Yale University Investments Office. He spent a summer job and two years after business school investing directly at three of Yale’s managers.

Along the way, Ted was featured in Top Hedge Fund Investors: Stories, Strategies, and Advice, authored So You Want to Start a Hedge Fund: Lessons for Managers and Allocators, and made a ten-year charitable bet with Warren Buffett pitting hedge funds against the S&P 500. You can hear Ted’s story in his own words on Capital Allocators Episodes 45 (It’s Not About the Money), 34 (Deep Dive on Hedge Funds), and 5 (The Bet with Buffett).

Ted holds a BA, Cum Laude, from Yale University and an MBA from Harvard Business School.

Tell us about your event and the speaker you are interested in booking and we will be in touch right away.